Blog

Acctual Team

•

Nov 4, 2024

The internet allows you to communicate and work with people anywhere in the world. It’s instantaneous and free. So why is the payment industry so slow and antiquated?

You can instantly do business with someone thousands of miles away over video chat, but it takes days (or weeks) to get paid… If you’ve experienced this, then you might be interested to learn how cryptocurrency solves this headache. This is why people refer to it as Internet money.

The global cross-border payments industry is estimated to reach $350 billion by 2032. Traditional finance methods struggle to cope with such globalization, opening the door for cryptocurrency solutions to muscle in on the industry. In this article, we’ll explore cross-border payments in crypto, cross-border transactions on blockchain, and free tools you can use for your business.

What are cross-border payments?

Cross-border payments are transactions in which the payer and the recipient are located in different countries. This means money has to make its way from one country to another ‘across borders’. In the process, money passes through different banking systems and currency exchanges.

That all causes:

High transfer fees

Bank fees

Currency exchange rates

Slow transaction times - days or weeks!

For example, a company based in the United States that hires a marketing firm in Australia is going to need to send regular monthly payments. Each time it requires U.S. Dollars to be sent to Australia, and converted to Australian Dollars along the way. In the traditional banking system, this requires the money to pass through multiple third-party banks and exchanges. These ‘middlemen’ all charge a fee and slow the process down.

How do crypto cross-border payments work?

Cryptocurrencies run on technology called blockchain. It’s a peer-to-peer network facilitating the process of recording transactions and tracking assets.

It allows digital currency to be sent directly from one person to another over the internet, anywhere in the world.

No need for banks or middlemen to slow payments down and take a cut.

Blockchain networks are also decentralized, meaning no single government or organization controls them. Instead, anybody can access, audit, and process transactions.

Clever design systems like proof-of-work and proof-of-stake allow thousands of computers all around the world to validate transactions and earn rewards for participating in the network.

To start using cryptocurrency payment networks for cross-border transactions, all you need is a computer or phone and an internet connection. There’s no gatekeeping from the bank, and there is no need to provide endless documentation to open an account. In just a few minutes, you can set up a crypto wallet and receive funds from anywhere in the world. It’s a democratic, open-use payment network.

Why crypto is important for cross-border payments

Cryptocurrency changes the way people interact and do business across the globe.

Here’s why:

Efficiency: At the base level, cryptocurrency gets rid of 3rd party middlemen. All blockchain money transfers and transactions are automatically confirmed without interference from an institution or government for seamless operations. It’s fast, it’s cheap, it’s efficient.

Speed: Modern cryptos confirm transactions in less than one minute. Even the oldest cryptocurrency, Bitcoin, processes transactions in ten minutes—far quicker than a Visa/MasterCard transaction, which takes at least three days. It’s convenient, too, operating 24/7, 365 days a year, so there are no frustrating bank holidays or ‘weekend hours’.

Decentralized nature: Nothing is more frustrating than having your bank account frozen or payments blocked. The decentralized design of crypto means no bank, corporation, or government can control or freeze your money. You don’t need to trust any 3rd parties with your funds, a benefit for cross-border payments where you might be skeptical about currency transfer service providers.

Transparency: Blockchains are public ledgers. This means anybody can view and audit transactions on the network. Funds can’t go missing during cross-border crypto payments. You can check the network to seamlessly keep track of who’s paid and when transfers were made. The network itself does all the historical record-keeping by stamping transaction data into a unique block that can never be edited or deleted. There’s no need to trace payments bank or request transaction history from the bank.

Programmability: Blockchain technology has become far more sophisticated than just cryptocurrency transactions. They’re now programmable using smart contracts. Networks like Ethereum and Solana use this technology to automate payments based on predetermined events and outcomes. This enables peer-to-peer cross-border banking, lending, and savings. This is what’s referred to as decentralized finance or ‘DeFi’ where payment applications become more complete and intraoperative than traditional finance allows.

Stability: Problems like hyperinflation and governmental financial mismanagement often dog developing countries. Often this results in the valuation of the local fiat currency to vary wildly and low trust in that currency. In this situation, cryptocurrency becomes a useful asset to store money and make international payments. Adding to this, it is estimated that 46% of adults in developing economies are still unbanked due to inadequate banking infrastructure. Imagine a freelancer not able to open a bank account to receive payment, but with cryptocurrency like USDC stablecoin, they can get paid with nothing more than an internet connection!

Stablecoins: Cross-border crypto payments in action

A stablecoin is a cryptocurrency designed to retain a stable price. Normal cryptocurrencies like Bitcoin and Ethereum are incredibly volatile. This isn’t ideal for cross-border payments if the value of a payment changes dramatically between invoice and payment.

Cross-border stablecoin transactions solve this volatility issue. Stablecoins act as ‘digital dollars’. For example, USDC and USDT stablecoins are always worth $1. With stablecoins ‘pegged’ to the dollar, it’s become easy to make payments in cryptocurrency worth the same value as a traditional payment. Most organizations trading internationally will need to access US Dollars at some point but outside of North America, it can be a challenge. Stablecoins completely revolutionize this.

Stablecoins are one of the industry's hottest topics

In many ways, just like email transformed the traditional mail industry, stablecoins transform the payments industry.

USDC and USDT are the two biggest stablecoin cryptocurrencies and are considered the best crypto assets for cross-border payments. Combined, they boast a total market cap value of over $150 billion. USDT alone processes billions of dollars worth of transactions every day and is the 3rd largest cryptocurrency after Bitcoin and Ethereum.

They have become integral in the cryptocurrency ecosystem with more than 50% of all crypto transactions occurring using stablecoins. Virtually, every blockchain network has a stablecoin built into its architecture.

Adding to this, all major crypto exchanges embrace these stablecoins as they make it easy for new users to understand when depositing funds and cashing out their crypto. Plus, stablecoins are extensively used as trading pairs against the more volatile cryptos.

Three types of stablecoins

As every blockchain and DeFi project now integrates a stablecoin, they come in all shapes and sizes. In general, they are developed in 3 particular ways. Here are the differences:

Fiat-collateralized: USDT and USDC are both fiat-collateralized stablecoins. This means for every 1 USDT/USDC there is $1 stored in a reserve bank account. For example, to create 1 USDT, $1 must be deposited. To reclaim the original $1, the 1 USDT must be destroyed or ‘burned’. It’s a little bit like the old gold standard where fiat money was literally backed by gold. You couldn’t just create money out of thin air, it had to be backed by a real asset. This style of stablecoin is simple to understand and dominates the market.

USDC by Circle, a fiat-collateralized stablecoin, is one of the most trusted digital assets in existence

Crypto-collateralized: These work in a similar way to fiat-collateralized coins but instead you deposit other cryptocurrencies as collateral against the stable coins. The stablecoin is then pegged to the value of the cryptocurrency it’s backed by. Market volatility means these stablecoins are often over-collateralized to hold a larger protective reserve. They tend to have more risk involved as market volatility can quickly remove the coin from its peg and lose its value.

Algorithmic: It’s been a bumpy ride for algorithmic stablecoins. The premise is to rely on preprogrammed algorithms to adjust their price based on supply and demand. When demand increases the system mints new tokens and when demand decreases it burns tokens to reduce supply. A nice idea to get rid of any need to trust 3rd parties to store reserve funds. But it has led to extreme collapses, you might remember the UST Terra Luna collapse. $60 billion got wiped out in a matter of hours. Similar to a run on the bank, hundreds of millions were liquidated at once, sending the algorithm into meltdown, further exacerbated by panicked traders. It never recovered.

The future of stablecoins

Clearly, stablecoins are an integral player in the crypto landscape, but you don’t have to be a genius to see how they revolutionize cross-border payments. Wherever you’re sitting in the world reading this, you could receive a stable valued cryptocurrency in a matter of seconds at almost no cost. In a hyperconnected world, that’s pretty handy.

Many predict that stablecoins will become the most dominant crypto assets once the industry matures. Volatility is perhaps the biggest criticism of the technology so stable digital assets will be key to integrating DeFi into traditional finance (aka TradFi).

Governments are constantly playing catchup against the crypto world and often regulatory pressure stunts the growth and acceptance of technology like stablecoins. At the very least, most governments are concerned about the destabilizing effect digital currencies could have on fiat currencies. The future adoption of stablecoins could well depend on whether or not they are embraced by governments and traditional financial institutions.

The risks of crypto cross-border payments

Using cryptocurrency for blockchain cross-border payments is quick, cheap, accessible, and efficient. It does come with risks though, it’s important to be aware of these before you get started.

Crypto payments are irreversible, so there’s no mechanism for getting your money back if you make a mistake. There’s nobody to call if you make a mistake and you can’t reverse a charge like a credit card. Proper accounts payable/accounts receivable processes are critical and Accutal provides a solution for businesses and freelancers globally to prevent any issues.

In several ‘black swan’ events, crypto exchanges have gone bust, been hacked, or scammed users out of their money - the most famous being Mt. Gox and FTX. This makes it doubly important to find exchanges you can trust when depositing and withdrawing funds.

Generally, there’s no consumer protection for mistakes and lost funds so they become almost impossible to recover.

Cryptocurrency users often choose to ‘self-custody’ their funds. That means they hold their crypto in a digital wallet on their computer, phone, or external device. This removes the risk of a 3rd party company like an exchange losing your money. However, self-custody requires the implementation of robust security practices to protect against theft and loss of your crypto.

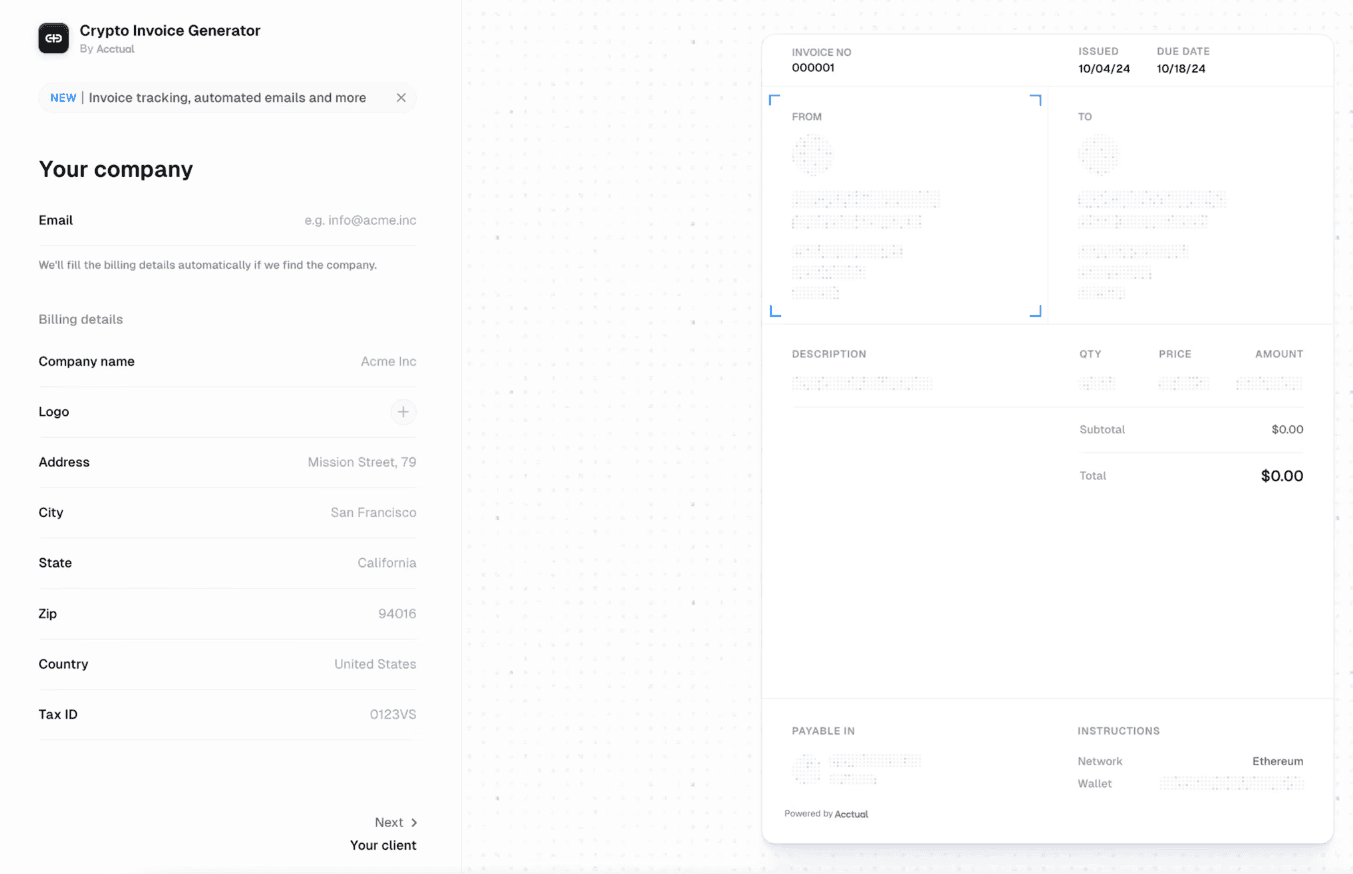

Complete cross-border payments with Acctual

Cross-border payments are frustrating at the best of times. Even if things go smoothly, it always feels like you end up with less than you should.

Extra fees, rubbish exchange rates, and slow service. It’s no fun.

Stablecoin cross-border payments solve this problem. They give businesses and freelancers the means to exchange globally using the US Dollar. Actual is the first tool giving you the tools to manage these stablecoin payments efficiently, anywhere in the world.

Now you can send and receive payments anywhere, anytime, without a bank account. Over 3,000 people are now combining stablecoins with Acctual for automated cross-border payment invoicing. Whether you need to invoice for payments from the UAE to the United States, Philippines to Singapore, India to Nigeria, or any other location, it can be done easily.

Take Abasiubong for example. He’s a remote worker in Africa suffering from high transaction fees and delayed payments from clients abroad.

In the past he would use Paypal to try and solve the problems but still had to pay a ‘significant chunk of earnings’ during the cross border transaction.

Now he uses Acctual to create an invoice, send it and receive payment in crypto. In just a few hours he can receive and convert the crypto into Nigerian Naira at a competitive rate.

Smooth efficient, and cost effective. All without the worry of third-party fees, delay, and unnecessary stress. Now he can focus on delivering quality work and not suffering with payment issues.

Acctual gives you complete flexibility in how you invoice and make payment. As a business you can pay in cryptocurrency and your vendor can get paid in fiat currency. Or vise versa!

It’s easy for anyone to send an invoice via PDF or payment link, and get paid in crypto or into a bank account. Try out the free invoicing generator tool for yourself!

Blog